The Global South's overlooked fintech opportunity

The need for saver-first fintech solutions in high inflation economies of the Global South

Saving is one facet of financial activity where fintechs in the Global South can create a lot of value.1 And it remains underpenetrated.

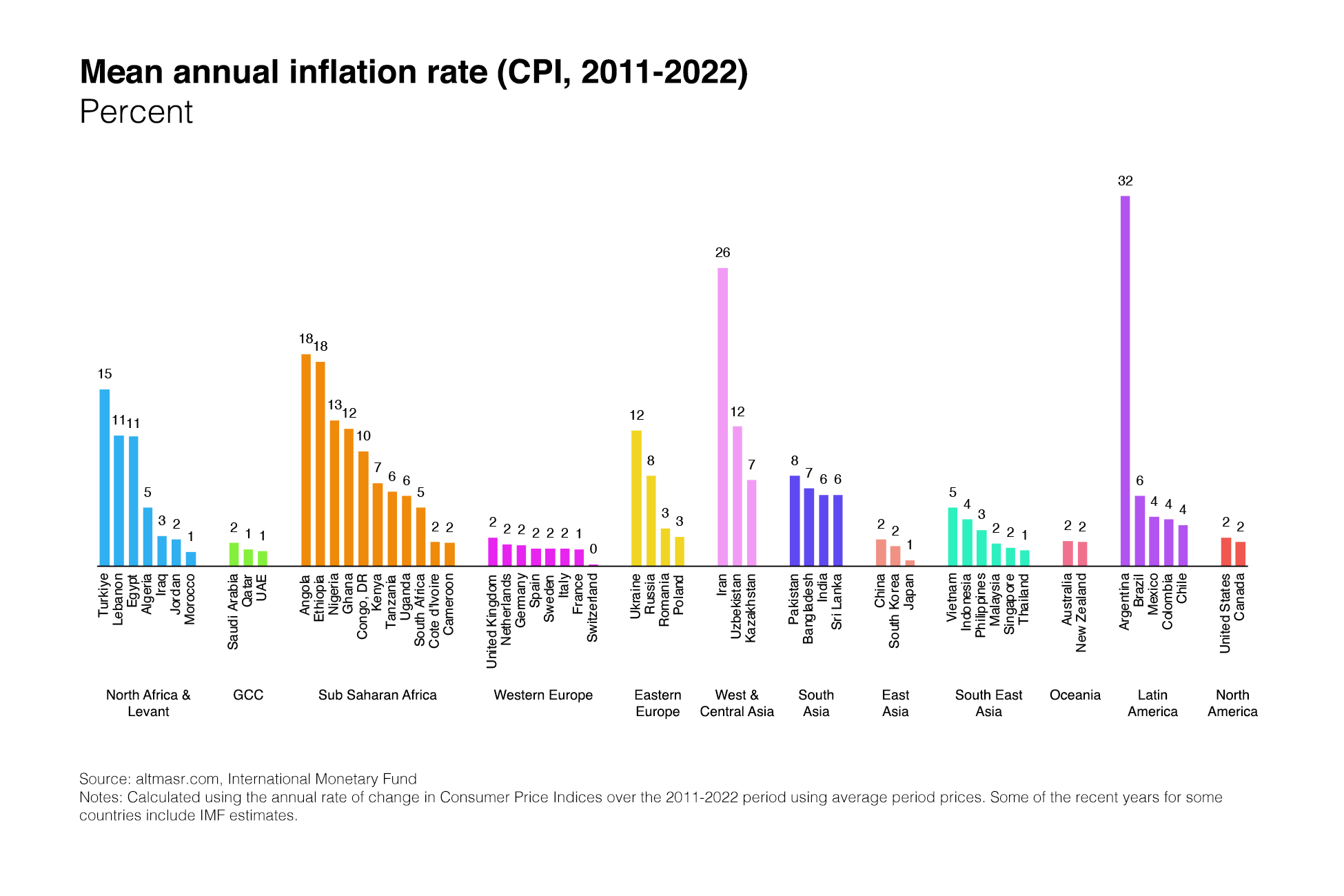

Households in the region have faced difficulty in building meaningful wealth over time. The real value of their savings is constantly being eaten into by high levels of inflation – disproportionately higher than those of their counterparts in the North. Weak currencies and import-dependent economies are often the root causes.

And there is practically little they can do about this phenomenon. Counteraction requires radical economic transformation and adept political leadership, both of which have by and large been elusive.

Meanwhile, their access to savings and investment products has been hindered by broadly 4 factors: rentier domestic financial institutions that have a vested interest in maintaining the status quo, a lack of a broad and diverse domestic asset universe, financial exclusion from big-ticket investments (e.g. real estate), and foreign exchange controls.

The capacity for tech to come in and transform the savings/investment industry is substantial. There’s been plenty of regional investment in availing credit products to consumers, and with good utility. But it needs to be balanced with universal access to savings products to be sustainable, particularly considering the rate of deterioration of wealth.

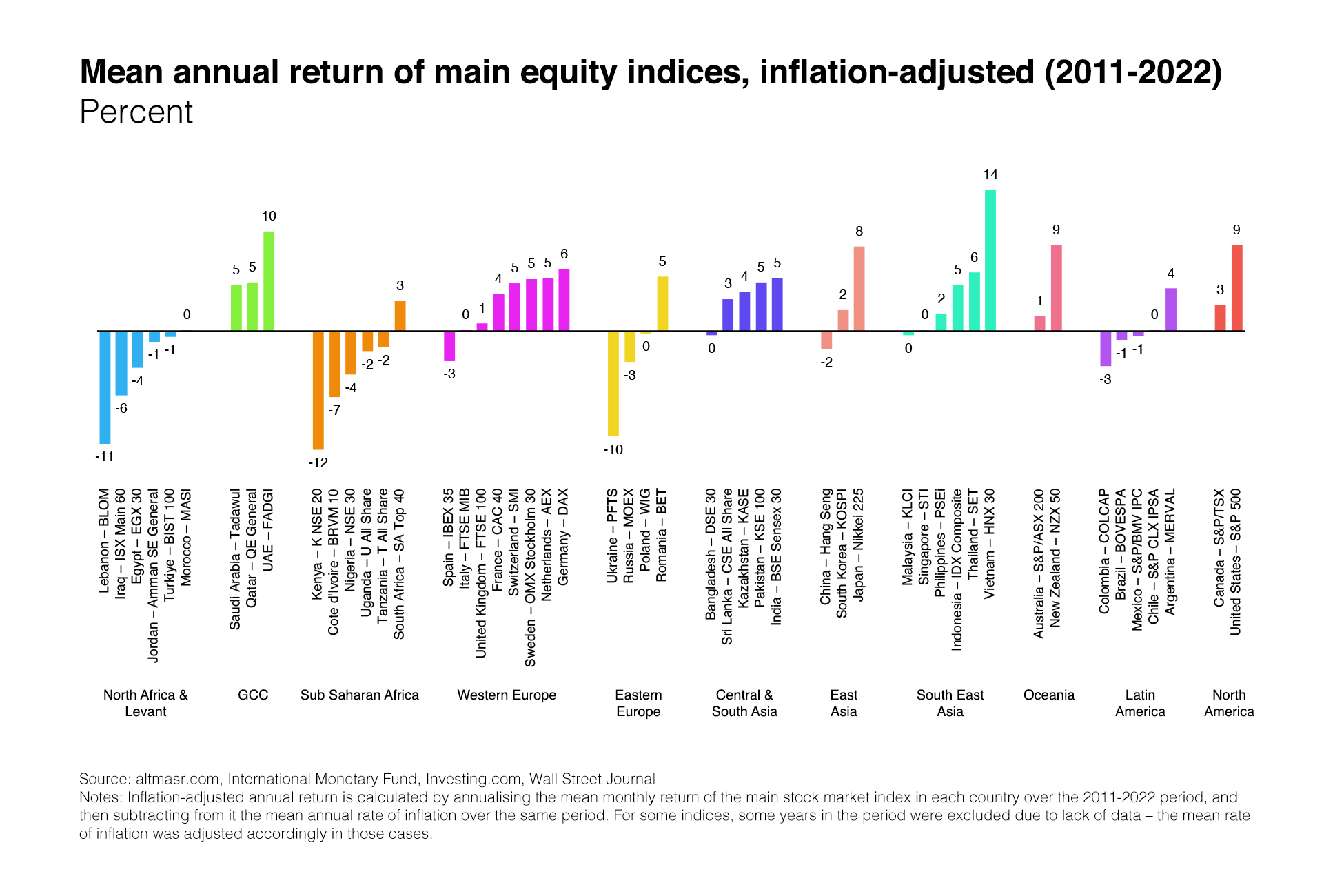

While the tech-driven democratisation of stock market investment in the North has been laudable on the whole, economies in the South are fundamentally different and availing wealth-related products to them requires a more nuanced approach. The quality of assets listed on domestic exchanges is something to consider, as well as their liquidity and their capacity to generate real returns over time – ones that exceed the rate of inflation. There is considerable utility in broadening the universe of quality investable assets domestically and availing access to foreign ones. Cooperation between fintechs and the regulatory sector on that is expected to be a core regional theme.

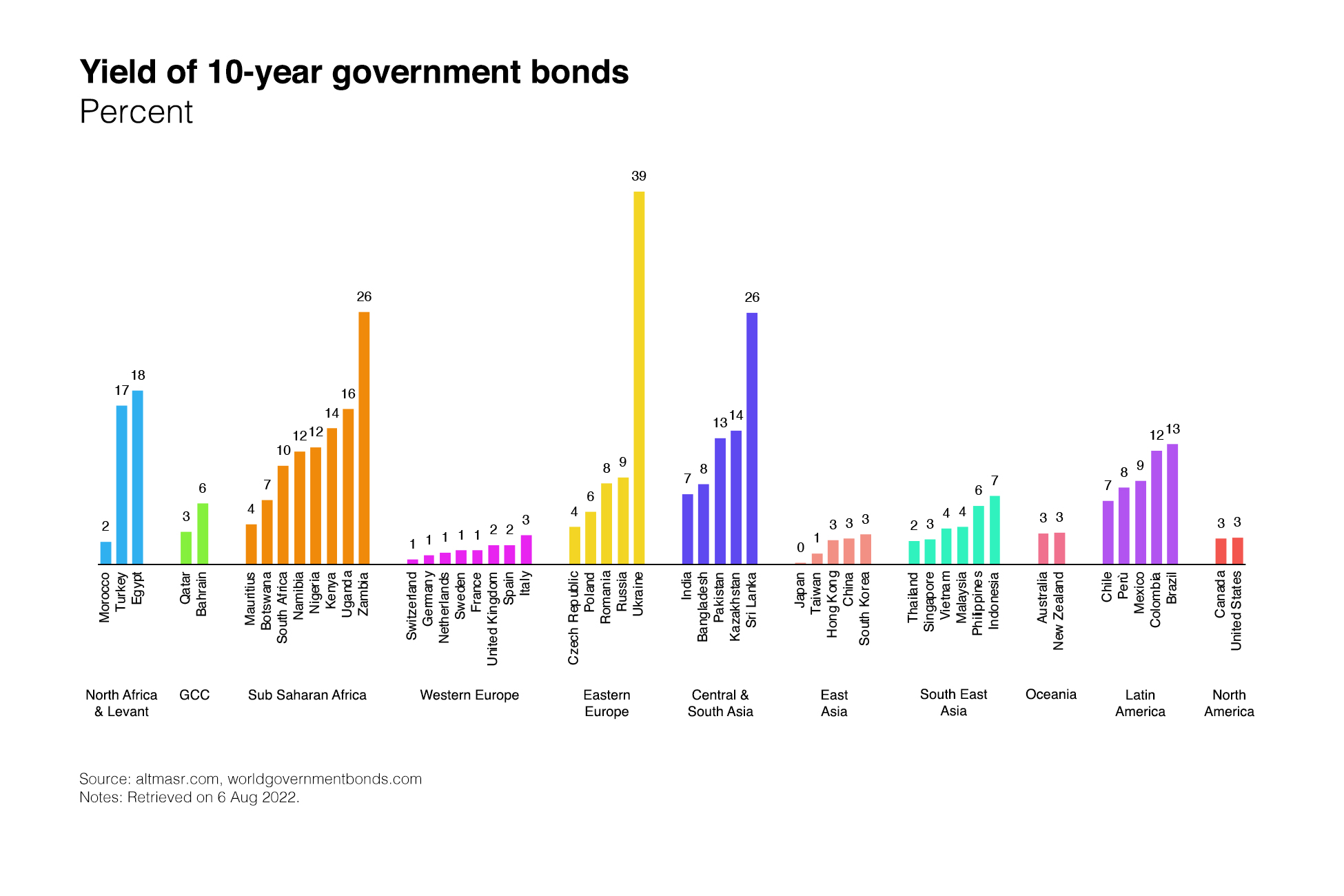

Democratising access to money- and fixed-income markets would also create meaningful value to savers. Treasury bills and bonds in the South commonly offer exceptionally high yields – ones that are more attractive than implied domestic stock market returns. This is particularly true in countries with chronic current account deficits and lots of government debt. These high yields are a bargain for domestic deposit-taking institutions (notably Egyptian banks) – they’re low risk, liquid, and the earned spread (after accounting for the meagre rate paid to depositors) is exceptionally lucrative. Availing households access to participate directly in such markets would create significant value for them.

The transient value of cash in these economies have led some to invest in alternative assets that are good hedges of inflation, such as land and real estate. Yet, given the low incomes and wealth disparities in the region as well as the ticket sizes in those markets, large swathes of the population are excluded from participation. A lot of value can be derived from giving these households access to upside in those markets. The blockchain and fractionalisation are technologies that allow this to be applied on a wide-scale.

Of course, in the long-term there is an onus on Southern governments to do better as well as on the international monetary system to level the currently-biased playing field (crypto is a compelling attempt) – such high inflation levels are not conducive to productive economic activity. Yet in the meantime regional households should not continue to be unjustifiably and disproportionately excluded from meaningful wealth building.

Keep an eye out for fintechs solving for these issues – they’re tackling a large and potent regional need.

-

Global South here refers broadly to Africa, Latin America, and Asia, with the possible exception of the GCC, East Asia, and Singapore. ↩

#startups #entrepreneurship #economics #fintech #global_south #savings #stock_market #wealth